Roth 401k rmd calculator

The RMD rules also. 0 Your life expectancy factor is taken from the IRS.

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Web Her 401 k had a balance of 250000 on December 31 2020.

. If you are in a 28000 tax bracket now your after tax deposit amount would be 300000. Explore Choices For Your IRA Now. Web How is my RMD calculated.

Web Calculate the required minimum distribution from an inherited IRA. Build Your Future With A Firm That Has 85 Years Of Investing Experience. A 401 k can be an effective retirement tool.

Ad Get Up To 600 When Funding A New IRA. As of January 2006 there is a new type of 401 k contribution. Schedule a call with a vetted certified financial advisor today.

That distribution age is 70½ if you reached. Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Web Required Minimum Distribution Calculator.

A 401 k can be an effective retirement tool. Roth IRAs are the only tax-sheltered retirement plans that do. The Uniform Lifetime Table lists Hannahs distribution period as 256 years.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Protect Yourself From Inflation. Web For the 2021 you can contribute up to 25 of your retirement asset balance or 135000 whichever is less.

How to pick 401k investments. Use this calculator to determine your Required Minimum Distribution RMD from a traditional 401k or IRA. Dividing her balance by her.

Web The terms of Roth 401k accounts also stipulate that required minimum distributions RMDs must begin by age 72. How does a Roth IRA work. Use the tool to compare estimated taxes.

For example if you have an IRA with a balance of. Roth 401 k contributions. Ad Compare your matched advisors for fees specialties and more.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. As of January 2006 there is a new type of 401 k -- the Roth 401 k. The topic has gotten a lot of press in.

In general your age and acc. However the RMD rules do not apply to Roth IRAs while the owner is alive. Web The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans.

Traditional 401 k and your Paycheck. Web 2022 Roth Conversion Calculator This calculator can help you make informed decisions about performing a Roth conversion in 2022. Web How much should you contribute to your 401k.

Wed suggest using that as your primary retirement account. The Roth 401 k allows. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Web 401 k RMDs are calculated by dividing the account balance in your 401 k by what is called a life expectancy factor which is basically a type of actuarial table. Web The RMD rules also apply to Roth 401k accounts. You can contribute up to 20500 in 2022 with an.

See the worksheets to. You will save 14826875 over 20 years. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Web WealthTrace is more comprehensive than any free Roth conversion calculator and will allow you to run accurate Roth conversion scenarios. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Web Calculate your earnings and more. Return to List of FAQs. 401k Roth 401k vs.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Web If you have a 401k or other retirement plan at work. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution.

You are retired and your 70th birthday was July 1 2019. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Ad Use This Calculator to Determine Your Required Minimum Distribution. Web There is no required minimum distribution RMD for Roth IRAs unlike those required for traditional IRAs or 401ks.

Account balance as of December 31 2021 7000000 Life expectancy factor. Strong Retirement Benefits Help You Attract Retain Talent. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs.

Rmd Table Rules Requirements By Account Type

Rmd Calculator Required Minimum Distributions Calculator

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

The Ultimate Roth 401 K Guide District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

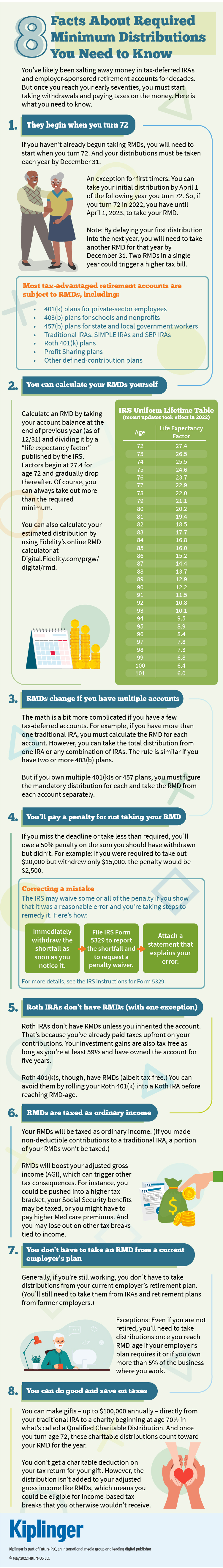

8 Facts About Required Minimum Distributions You Need To Know

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Required Minimum Distribution Calculator Estimate Minimum Amount

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Rmd Table Rules Requirements By Account Type

How To Calculate Rmds Forbes Advisor

Required Minimum Distribution Rules Sensible Money

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Required Minimum Distribution Rmd By Age Self Directed Retirement Plans

What Is The Required Minimum Distribution From Retirement Accounts The Heritage Law Center Llc

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital